Cyprus banks prepare to reopen

Good morning, and welcome to our rolling coverage of the crisis in Cyprus.

What happens if you close a country's banks for almost two weeks, restrict cash withdrawals, agree swingeing controls on taking money out of country, and then reopen the branches again?

Panic? Anger? Or calm?

We'll find out this morning, as Cyprus's banks open their doors for the first time since the country signed up for its ill-fated bailout package 12 days ago.

It's a remarkable situation -- last night, trucks (apparently) carrying containers of euros arrived in Nicosia amid tight security. Hundreds of staff from the private security firm G4S are also guarding branches and shipping money around Cyprus to ensure branches have sufficient funds to cope.

The banks are due to reopen at noon Cyprus time, and run until 6pm, so 10am-4pm GMT.

Last night Cyprus finally agreed the details of tough capital controls to limit money flooding out of the country. Limiting people to taking out just €300 per day is meant to prevent a bank run.

So perhaps all will be calm. We'll see....

Updated

Cyprus stock market drops plans to reopen

Breaking news: the Cyprus stock market has just announced that it will not reopen his morning.

That's a surprise -- the bourse had been scheduled to begin trading after its own suspension.

More as we get it....

Updated

Early calm in Cyprus ahead of bank reopening

The situation in Cyprus appears pretty quiet so far.

Instead of a bank run, there are reporters racing around the branches -- and the good news is that they haven't found any signs of trouble.

Cash is being delivered by security teams to branches, that are currently expected to open in 2 hours time.

Another sign of early calm - journalists outnumbering customers at this bank:

Matina also confirms that there's "no hysteria", but security guards are stationed outside branches.

Capital controls decree

As Hoth25 wittily pointed out in the comments threadt below, Cyprus bank customers can only withdraw €300 from their account per day. So you can't simply show up, empty your account and transfer it to your mattress.

That restriction was confirmed under the capital controls announced late last night. You can see the final decree on capital controls here:

It's broadly as expected:

• cashing cheques is banned,

• people can only carry €1,000 each when they leave the country

• Savings accounts cannot be accessed early (except to pay a loan)

• transferring funds abroad is heavily restricted: (businesses must seek approval for payments over certain levels, people abroad can only withdraw €5,000 per month on their cards, payments to students overseas are capped at €5k+ tuition fees per quarter).

And the decree "shall apply for a seven day period starting from the day of its publication in the Official Gazette of the Republic".

Updated

EC backs capital controls, for now...

The European Commission has supported Cyprus's decision to impose capital controls, but urged the country to lift them as soon as possible.

In a statement this morning, the EC said it had made a 'preliminary assessment' that the measures restricting the movement of capital are legal:

In current circumstances, the stability of financial markets and the banking system in Cyprus constitutes a matter of overriding public interest and public policy justifying the imposition of temporary restrictions on capital movements.

The EC added that it will continue monitor the need to "extend the validity of or revise the measures", to make sure they are proportionate to the need to maintain financial stability in Cyprus.

While the imposed restrictive measures appear to be necessary in the current circumstances, the free movement of capital should be reinstated as soon as possible in the interests of the Cypriot economy and the European Union's single market as a whole.

Photos: Cyprus banks get ready

A couple of photos from inside a Laiki Bank branch.

Laiki is being wound-up under the bailout deal agreed last week, but its customers (with under €100k) will be transferred to Bank of Cyprus.

Helena Smith: The shock in Nicosia

The scene on the ground in Nicosia is quiet but, as our correspondentHelena Smith reports, people are also struggling to cope with the trauma of recent days.

Helena writes:

On the streets of Nicosia it is busy as usual. At the best of times the Cypriot capital is a sleepy place, languorous and laid back.On the face of it today is no different - shops are open, clinics are accepting patients, people are sweeping the front steps of their homes and apartment blocks.When I ask a Greek Cypriot Orthodox priest in a stovepipe hat whether today is a big day, he responds with a simple shrug and smiles. But there is no denying that this is a populace in deep shock with many repeatedly likening what has happened to them with the sudden death of a loved one."We're feeling the same sort of emptiness," said Afrodite Elisaou, a doctor whose husband works in Laiki and still has no idea whether he will have a job tomorrow."It's the shock of it happening overnight, of going to sleep thinking you have a job and waking up not having one. Had all this happened to us gradually, and not in a day, it would have been much better."

Hats off to the Telegraph's Nick Squires for interviewing the Cypriot with the parrot on his head (see 9.00am) outside a bank branch.

The man is 87, the parrot is 67. One of them is called Costas; it is not clear which as his English is negligible.

Cyprus bank deposits fell before bailout - ECB

Now this is interesting. Private sector deposits in Cyprus fell by 2.2% in February, to €46.4bn, according to data released by the European Central Bank.

The drop in savings levels, which matches a fall in January, came as deposits in Greece rose by 2.2%, to €171bn.

Such monthly figures are volatile, but they do suggest that some Cypriot depositors were canny enough to shift their savings abroad before the bailout was agreed (on 16 March).

Martin van Vliet of ING commented:

A further sharp decline in Cypriot bank deposits in March looks all but guaranteed.More importantly, however, next month’s figures will shed more light on how (large) depositors in other peripheral countries have reacted to the uninsured-depositors-will-be-hit Cyprus bailout deal.

The entire board of Laiki Bank (Cyprus Popular Bank) have submitted their resignations, according to a filing to the Athens stock market (Reuters reports). Laiki, of course, is being wound-down under the bailout agreement.

Speaking of Laiki, Tanya Talaga of the Toronto Star flags up that customers are encouraged not to abuse its bank staff today:

Many Laiki staff are likely to lose their jobs when its toxic assets and large deposits are placed in a 'bad bank' and run down, with its small deposits heading to Bank of Cyprus.

The queuing customers don't look likely to riot, though. Many are elderly people, who don't own ATM cards.

No panic here

People began entering one Bank of Cyprus branch in Nicosia in an orderly fashion, under the watching gaze of Sky News.

There was a security guard on hand to prevent a crush inside, but no suggestion of panic.

One gentleman, Mr Lucas (80), explained:

They have stolen our money... which we have been working for 60 years.How are we going to live?

Updated

At some branches, customers are being allowed in one at a time to ensure order.

Everyone was also handed a copy of the capital control decree agreed overnight - so they are aware what they can, and cannot, do

Some branches don't open on time

It's clear now that several branches failed to hit the noon deadline to open their doors:

Helena Smith: Pragmatism and preaching at the Bank of Cyprus

Four people at a time being allowed in at the Bank of Cyprus branch on Evrou Avenue.

Helena Smith is there, and reports a sense of pragmatism, not panic:

"I want to cash my salary," says Christina Andreou wielding a cheque for €1300."There's no point being anything but patient. Fighting is going to get us nowhere," says Dinos Volides who turned up at bank with a cane. "Everyone in the bank is trying to be as helpful as possible."The only commotion, so far, has come from a woman visitor from Catford who is giving rousing speech outside the bank invoking the crowd to remember "the suffering of the Lord on Good Friday.Ask for his forgiveness, acknowledge that you have gone astray," she says.

Updated

Good news. The three branches which didn't manage to open in time for 10am GMT (see 10.26am) are now all dealing with customers.

It's a good effort by staff after the 12 day bank holiday; many don't know how much longer they'll have a job.

Natalie Powell of @featurestory reports that many Cypriots say they have no intention of pulling all their savings out of the bank. In fact, they plan to leave it there to support Cyprus.

She reports:

A lot of people are saying to me that they are not intending on taking all of their savings out of the bank, or even trying to....The country needs money, and they will keep that money in the banks and support them.

Updated

One of our readers in Nicosia has very kindly provided this report of the situation an hour ago at a local branch:

There was a queue of about 12 outside the large Bank of Cyprus Branch on Strovolos Avenue. in Nicosia.I do not know how many were inside, but the banking hall would accommodate 30 or more. All was calm and orderly. No police or security staff visible.We have used internet banking to transfer a very few hundred Euro from a BoC Instant Access account to a BoC current account. The transaction was accepted, but is marked as awaiting confirmation.

He also points out that Cyprus will not be marking Good Friday with a bank holiday -- the Greek Orthodox Easter is some weeks away.

Monday is a bank holiday - for Cyprus Independence Day.

Latest photos from Cyprus:

This photo shows a Laiki Bank manager tries to calm depositors waiting for the opening of the bank's branch in Nicosia.

And here's a man leaving a Bank of Cyprus branch in the Cypriot capital, Nicosia.

Eurozone deposits fastest to leave Cyprus in February

Further evidence that bank accounts started emptying before the Cypriot bailout...

From Reuters:

Savers from other euro zone countries withdrew 18% of the cash they held in Cyprus in February, amid fears the struggling island would impose a tax on bank deposits.Figures from the Central Bank of Cyprus published on Thursday show deposits from other euro zone states fell €860m to €3.9bn making them the fastest category to leave the stricken country.

I mentioned earlier that total deposits in Cyprus's outsized banking sector fell by over 2% in February. So it appears that foreign savers, not ordinary Cypriots, were the primary cause.

This eurozone data obviously excludes any movement of deposits to Russia.

Channel 4's Faisal Islam spies a dozen private jets at the runway at Larnaca Airport, in Cyprus, and different ones from his last visit:

(corrected as I rather misread Faisal's tweet originally. Apologies - roll on Easter....)

Updated

Cyprus's president thanks people for showing calm

The president of Cyprus has thanked the Cypriot people for the "maturity and collectedness" shown today as the country's banks reopened.

Relive the crisis

The eurozone has now been locked in a crisis for three and a half years, since Greece first admitted that there was a black hole in its accounts.

Since then we've seen five rescue packages (Greece, Ireland,Portugal, Spain's banking sector, and finally Cyprus), two unelected prime ministers (in Greece and Italy),widespread protests, lengthening jobless totals and an ongoing recession.

There was quite a queue outside this branch of the COOP Bank in Nicosia today.

Worth noting that not everyone has turned up at the bank to access their savings - some have said they were actually paying money or chequesin.

Passengers at Larnaca airport are warned that they cannot take more than €1,000 out of Cyprus, under the new rules on Capital Controls announced last last night (see details here).

Here's a gallery of photos from Cyprus so far today: Cyprus banks re-open - in pictures

From Nicosia, Associated Press reports that Cypriots formed 'large but orderly lines' to get into banks which have been closed since Saturday 16th March.

People filed calmly into banks across the country once they had opened, and no crowd issues were reported....

Although people were calm, there was also concern that the restrictions on withdrawals (people can only get €300 per day) would be disruptive:

In Nicosia, one 70 year-old pensioner who only gave his name as Ioannis arrived at the bank some two hours ahead of the scheduled opening time."I had to come this early, I came from my village 20 kilometers away, what do they want me to do, keep coming and going?" he said

Cyprus president takes pay cut

Cyprus's president is taking a 25% pay cut in 'solidarity' with the Cypriot people.

The move was announced in Nicosia this afternoon. AP has the details:

Cyprus' president has cut his salary by a quarter in a show of solidarity with ordinary Cypriots feeling the effects of the country's severe financial crisis.President Nicos Anastasiades authorized the country's accountant-general to make the pay cut, undersecretary to the President Constantinos Petrides.Anastasiades' Cabinet ministers have also decided to slash their own wages by 20%.Cypriot banks reopened for the first time in nearly two weeks Thursday after they shut down to prevent people from withdrawing all their savings and triggering further chaos in the country's financial system.

Back in February 2012, Greece's president surrendered his entire salary - worth almost €300,000 per year (see here)

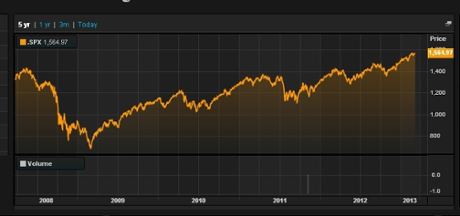

Stock markets cheered by lack of panic

Relief that Cyprus's banks reopened so smoothly has pushed shares higher in Europe and on Wall Street, where the S&P 500 has risen over it's previous closing lifetime high.

Here's the latest prices:

FTSE 100: up 41 points at 6428, +0.65%

German DAX: up 44 points at 7,833, +0.76%

French CAC: up 37 points at 3,748, +1%

Spanish IBEX: up 35 points at 7,935, +0.455%

Italian FTSE MIB: up 83 points at 15,437, + 0.55%

Dow Jones Industrial Average: up 42 points at 14568, +0.3%

S&P 500: up 2.49 points at 1565.34, +0.16%

The euro is also up this morning, gaining half a cent against the US dollar to $1.283.

Christopher Vecchio, currency analyst at DailyFX, says there had been fears of panic when the Cypriot government allowed branches to reopen:

There has been much ado about the potential for a bank runs in Cyprus, but thus far, predictions have fallen short of reality....I suggest that the capital controls in place – limiting Cypriots to withdrawals of €300/day – are the reason why we’ve seen a lack of panic; accordingly, without them, Cypriot banks would be seeing massive outflows.

Updated

Cyprus will probably have to wait a month until it learns whether the International Monetary Fund will contribute to its bailout package.

Although the IMF backed the deal put together in Brussels last Sunday, it has not yet confirmed that it will support the loan. It plans to spend several weeks considering the issue, which could mean a nervous wait for Nicosia.

IMF spokesman Gerry Rice told reporters that officials from the IMF, the EU and the ECB are currently in Cyprus working on technical details.

We expect the work of that mission to conclude in early April.After that our executive board will need to discuss the possible financing arrangement for Cyprus, so I would therefore not expect a final decision on a financial package from the IMF before the end of April.

The Troika of international lenders could have a busy April - they are also due back in Athens next week to assess Greece's progress...

Slovenia: we don't need a bailout

Slovenia's central bank governor has denied that his country is at risk of seeking a bailout.

With speculation swirling that Sovenia's banks are being dragged down by bad loans, Marko Kranjec told the STA news agency that the country was stable.

I can claim categorically that Slovenia is not in a position to need a bailout...But it is very important that policy makers give clear signals about stabilisation of public finances, rehabilitation of the banking sector and particularly of the real sector of the economy.

But Slovenia does have problems, as my colleague Jo Moulds explains:

The once-booming former Yugoslav republic was plunged into recession by the economic crisis, which dented demand for its exports of manufactured goods, machinery and transport equipment, chemicals and food. The economy is expected to shrink by at least 2% this year.But the statistic that has everyone concerned is the €7bn of bad loans on Slovenian banks' books, an amount equivalent to around one fifth of the country's total GDP. The rating agency Moody's has already downgraded Slovenia's second largest bank, and the IMF has estimated that the government needs to recapitalise the nation's lenders to the tune of at least €1bn.

No comments:

Post a Comment